Table of Contents

- This region of California faces unsustainable levels of inflation - Archyde

- Your California ‘inflation relief’ money may finally be in the mail ...

- Can California’s next governor fix the state’s problems? It depends on ...

- Ekonom: Inflasi Tembus 5,95%, BI Rate Akhir Tahun Bisa ke 5%

- Stronger inflation in 2025 on analysts’ radar | Economy ...

- California Economy & Taxes on Twitter: "Inflation has decreased from ...

- Inflation Worries Grow as Cal Legislature Approves State Budget – Los ...

- La California ritarda la piena applicazione delle norme sulla ...

- California’s Renewable Energy Penetration And Electricity Rate ...

- What Is The Inflation Rate In California 2024 - Casey Helaine

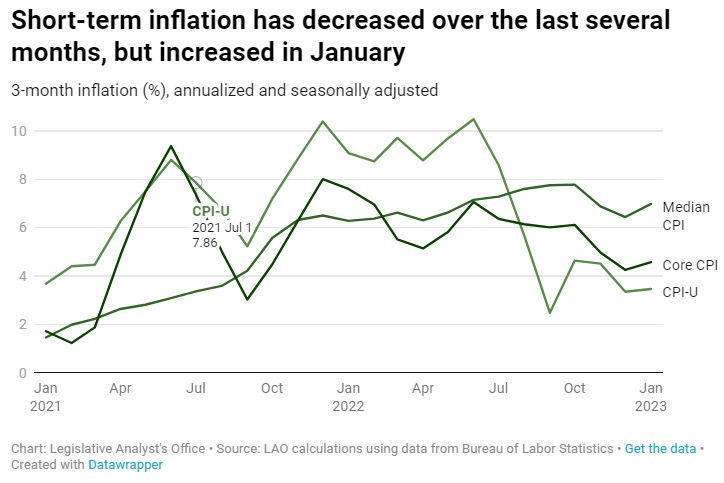

The inflation rate is a crucial indicator of a country's economic health, influencing everything from interest rates to consumer spending. It is essential to stay up-to-date with the latest inflation data to make informed decisions about investments, budgeting, and financial planning. The January 2025 inflation update reveals a mixed bag of trends, with some categories experiencing significant price increases while others remain relatively stable.

:strip_icc()/i.s3.glbimg.com/v1/AUTH_37554604729d4b2f9f3eb9ad8a691345/internal_photos/bs/2024/a/H/zPfuo6QCCtEj8I2dACWQ/110522bassoli11.jpg)

Inflation Breakdown for January 2025: Key Findings

| Category | Inflation Rate |

|---|---|

| Food and Beverages | 3.5% |

| Housing and Utilities | 2.8% |

| Transportation | 4.2% |

| Healthcare | 2.1% |

| Recreation and Entertainment | 1.9% |

As shown in the chart, the inflation rate for food and beverages has increased by 3.5% in January 2025, driven by higher prices for meat, dairy products, and fruits. The housing and utilities sector has experienced a 2.8% inflation rate, primarily due to rising rent and energy costs. Transportation costs have surged by 4.2%, largely attributed to increased fuel prices and vehicle maintenance costs.

Implications of the January 2025 Inflation Update

To navigate the current inflation landscape, it is essential to stay informed about the latest trends and developments. Consumers can take steps to mitigate the impact of inflation by adjusting their budgets, exploring cost-saving opportunities, and investing in assets that historically perform well during periods of inflation. Businesses can respond to inflation by implementing price adjustments, improving operational efficiency, and diversifying their product offerings.

The January 2025 inflation breakdown provides a comprehensive overview of the current state of the economy. By analyzing the inflation data and understanding the trends in different categories, consumers and businesses can make informed decisions about their financial plans and investments. As the economy continues to evolve, it is crucial to stay up-to-date with the latest inflation updates and adjust strategies accordingly. Whether you are a consumer, investor, or business owner, the January 2025 inflation breakdown is an essential resource for navigating the complex and ever-changing economic landscape.Stay ahead of the curve by monitoring inflation trends and making data-driven decisions. With the right information and insights, you can thrive in today's fast-paced economy and achieve your financial goals.